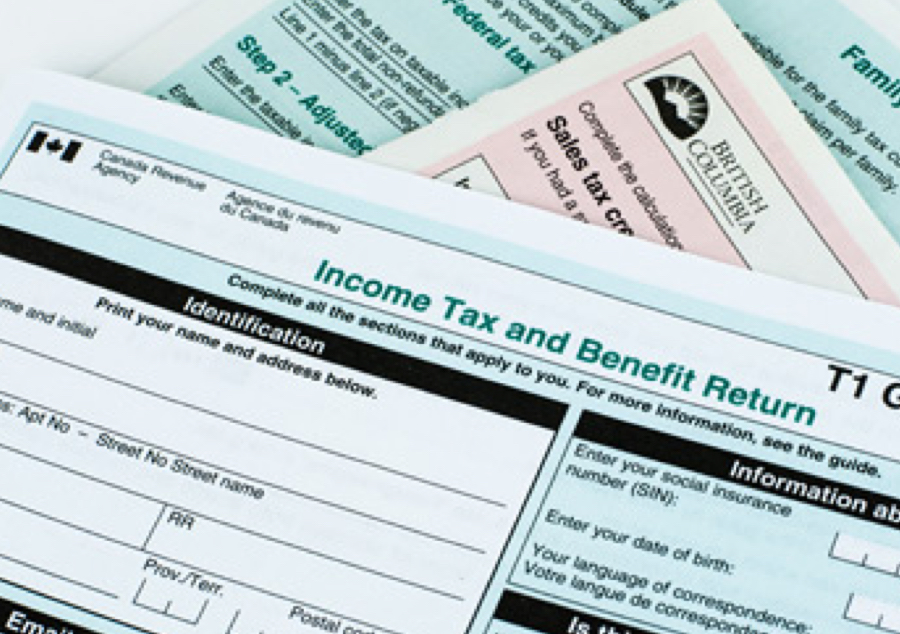

If you’re a foreign resident planning to sell a property in Canada, it’s essential to obtain a certificate of compliance. This certificate is required to confirm that you’ve paid...

Determining when to declare foreign property to tax authorities can be confusing, particularly with the extensive list of declarable assets. However, failing to declare foreign assets can result in...

As a Canadian resident or citizen, you may be considering investing in foreign assets, whether it be for diversification, increased returns, or protection against currency fluctuations. However, before making...

Freelancing has become a popular career choice for many Canadians, offering the freedom and flexibility to work on their own terms. However, with this freedom comes the responsibility of...

Taxation in Canada has undergone many changes in recent years to adapt to the country’s economic and social needs. The current tax system is more equitable, fair, and effective...

As a student, it’s important to be aware of the various tax credits available to you. These credits can help offset some of the expenses associated with your education...

Are you planning to purchase a new vehicle for your business soon? One of the decisions you’ll need to make is whether to register it in your personal name...

The decision to incorporate a business depends on several factors, such as business goals, personal aspirations, tax obligations, and personal protection. Here are some factors to consider when determining...

You do not have to declare certain non-taxable amounts as income which include in particular: most lottery winnings; most gifts and inheritance goods; amounts received from Canada or...